the

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

| ☒ | No fee required. | |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | ||||

|

April 17, 2023

Dear Shareholders:

2022 was a year of steady progress for Kelly as our team navigated dynamic geopolitical, macroeconomic, and labor environments. We entered the year with energy and optimism, poised to capture new growth opportunities that began to emerge as the pandemic loosened its grip on the global economy. The first half of 2022 followed a familiar trend of talent shortages coupled with strong demand for our services and solutions. Early in the third quarter, a mixed pattern of deceleration emerged in some sectors – driven by inflationary pressures and rising interest rates – which persisted through the balance of the year. Despite these headwinds, the Kelly team remained focused on executing our specialty strategy and creating long-term value for all our stakeholders.

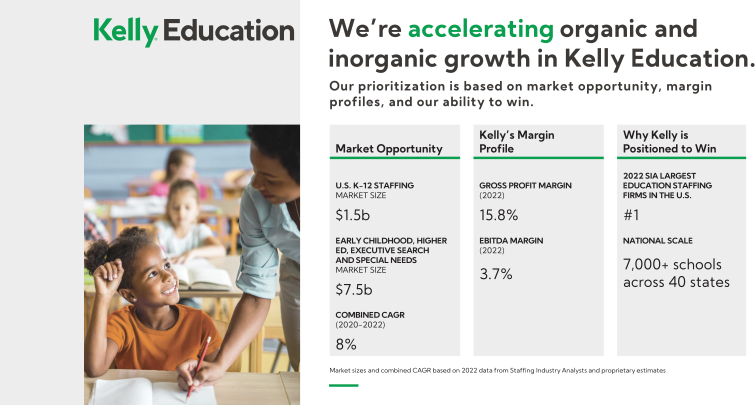

Executing Our Specialty Strategy Each of our five specialty business units made strategic contributions to Kelly’s progress on our growth journey in 2022. Our ability to capture strong demand in the first half – particularly in our Science, Engineering & Technology, Education, and OCG business units – set the stage for our team to deliver quality revenue growth for the full year. By intentionally pursuing higher-margin, higher-value business opportunities, we succeeded in expanding our gross profit margin in every segment, lifting Kelly’s gross profit margin above 20 percent for the first time in more than 25 years. Furthermore, we demonstrated our ability to effectively translate higher margins to earnings growth as we improved operating earnings 30 percent on an adjusted basis compared to 2021. Together, these achievements signal that our specialty strategy is delivering results. We also took several bold actions in 2022 to reallocate capital in support of our specialty strategy. In February, we ended the cross-ownership arrangement between Kelly and Persol Holdings and reduced our ownership interest in our PersolKelly joint venture. We redeployed a portion of the net proceeds from those transactions to advance our inorganic growth strategy while preserving the remaining capital to pursue additional high-margin, high-growth acquisitions in the future. We monetized non-core real estate holdings throughout the year as well, unlocking more capital to invest in growth initiatives. As a complement to these elements of our capital allocation strategy, we increased our dividend to its pre-pandemic level and authorized a $50 million repurchase of outstanding Class A common shares. These actions are indicative of a Kelly that acts decisively in pursuit of profitable growth and long-term value creation. |

Peter Quigley President and CEO |

Reinforcing Good Governance Practices

Underpinning our efforts to accelerate value creation is our unwavering commitment to effective corporate governance. In 2022, we welcomed two new independent directors to Kelly’s Board – Amala Duggirala and InaMarie Johnson – both of whom benefited from a new, robust director orientation program designed to empower them to quickly become valuable contributors to the Company’s governing body. We are appreciative of their service to our Board, as we are of all our distinguished directors whose insights inform key aspects of our strategy – from M&A and human capital management to digitization and cybersecurity. Each director brings a diverse set of experiences and skills that strengthen the Board’s ability to carry out its oversight role on behalf of shareholders.

| 1 |

Letter to Shareholders

Consistent with our commitment to transparency and accountability, we continue to strengthen our executive compensation and compliance practices as well. This includes disclosing additional information related to executive compensation that provides greater visibility into how we are aligning compensation with financial performance. We also implemented updates to our clawback and insider trading compliance policies that mitigate risk for the Company and our shareholders. Together, these changes contribute to a corporate culture that emphasizes good governance, compliance, and performance.

Elevating DE&I as a Business Priority

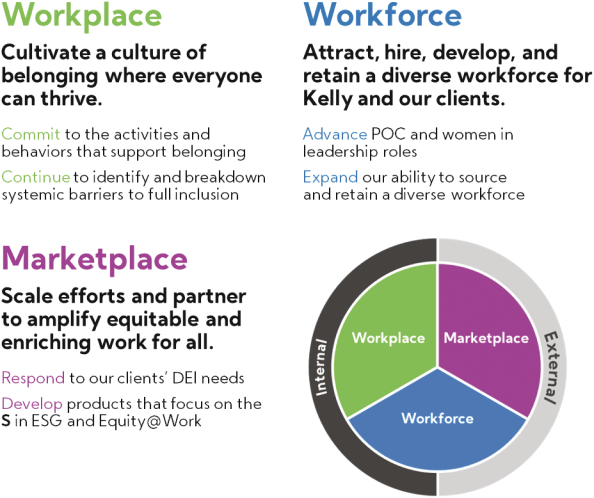

As we accelerated our strategic transformation in 2022, we also took action to advance our progress along our diversity, equity, and inclusion journey. In September, we announced the appointment of Keilon Ratliff as Kelly’s first Chief Diversity Officer and a member of the Company’s senior leadership team. Under his leadership, Kelly formed a Chief Diversity Office – a dedicated team of leaders who together are driving a multi-year strategy to integrate diversity, equity, and inclusion into our workplace, among our workforce, and within the marketplace.

The creation of the Chief Diversity Officer position with Kelly’s senior leadership team and the formation of the Company’s Chief Diversity Office demonstrates our continued belief that fostering diversity, equity, and inclusion in the workplace will position Kelly to compete and grow over the long term. Our abilities to innovate and meet the ever-changing needs of our talent and customers are dependent upon attracting and retaining talent with diverse perspectives and backgrounds and creating an environment in which everyone can thrive.

It also reflects our strategic intent to do well while we are doing good – a central tenet of Kelly’s integrated Environmental, Social, and Governance (“ESG”) reporting framework which we formally communicate through our Corporate Sustainability and ESG Report 2022 titled, “Growing with Purpose.” The report is prepared in alignment with the Global Reporting Initiative Standards set forth by the United Nations Global Compact Guidelines and discloses our corporate sustainability strategy as aligned to the ESG framework.

Unlocking Value Together in 2023

It is difficult to know how the macroeconomic situation will unfold as we move forward in 2023. What is certain is that we will focus on what we can control and stay the course in our aggressive pursuit of profitable growth.

In each of our business units, we will continue to shift toward a business mix characterized not only by higher margins and value, but greater resiliency amid market pressures. We will drive inorganic growth using the ample capital available to us to pursue additional high-quality acquisitions in our Science, Engineering & Technology, Education, and OCG business units. Furthermore, we will continue to invest in technology and new products that will improve the talent and customer experience, enable organic growth, and increase efficiency.

As the macroeconomic situation evolves in 2023, we are also committed to ensuring our cost base reflects our operating environment, our strategic priorities, and performance. Longer term, we are reviewing our growth and efficiency objectives as we approach the three-year anniversary of our operating model. Our focus is on creating additional levers for value creation.

Working as one team with our Noble Purpose as our guide, we will deliver on these priorities and create long-term value for all our stakeholders – helping our talent and customers thrive and rewarding you, our shareholders, for your patience since we embarked on this transformation.

| 2 |

| |||

| ||||

|

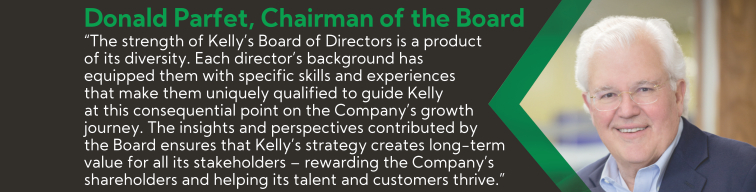

LETTER FROM THE CHAIRMAN OF THE BOARD

April 6, 2020

Dear Stockholders:

2019 saw a leadership transition for our Company and continued progress in corporate governance.

On October 1, 2019, Peter Quigley became our new President and CEO and joined our Board of Directors. George Corona stepped down as President and CEO for his planned retirement on June 30, 2020. Peter was selected following an extensive succession process conducted by the Board, involving internal and external candidates. Prior to becoming President and CEO, Peter spent 17 years in varied and demanding leadership roles at Kelly. With the support of the Board, Peter is leading the Company’s strategic transformation into a specialty talent company.

On behalf of the Board, I want to express our gratitude to Georgeentire Kelly team, thank you for his exceptional leadership. He has helped Kelly become a more focused company, make solid investments in technology and the future of work, and stay aligned with our Noble Purpose of connecting people to work in ways that enrich their lives. We are grateful for his 25 years of service to Kelly and pleased that George will remainyour continued support as we move forward on our Board and will be contributing his experiencejourney to Peter’s transition.

I would also like to take this opportunity to thank Takao Wada for his distinguished service onunleash the Board. Mr. Wada served as the designated representative of Persol Holdings, LLC, Kelly’s strategic partner in the Asia-Pacific region, and is not standing forre-election.

The Board is committed to sound corporate governance as a means of enhancing long-term stockholder value. We have a majority independent Board and fully independent Audit and Compensation Committees. Following our Annual Meeting, when we will make new committee assignments, our Corporate Governance and Nominating Committee will be fully independent. That will bring us to the important milestone of satisfying all the Nasdaq independence requirements for board and board committees that are applicable tonon-controlled companies.

Asfull potential of this writing, like most businesses throughout the world, we are confronting serious challenges raised by COVID – 19 (“Coronavirus”) for our Company, employees, and business partners. In response, Kelly implemented its emergency management procedures under which a cross-functional Emergency Management Team was assembled to coordinate crisis management for the organization, including containment measures, policies, communications, and resources. We have implemented measures designed to protect the health and safety of Kelly employees, including initiating travel restrictions, barringin-person attendance at conferences and large events, and restricting nonessential visitors from our buildings. Kelly’s adoption of information technology systems and policies that enable remote work are proving to be extremely beneficial during this time, and Kelly workers are able to perform nearly all essential functions remotely. When possible, Kelly is also working with its customers to implement remote work plans for temporary employees. Kelly will continue to adapt its approach in light of government actions, best practices, and the recommendations of public health officials. As we get closer to the date of the Annual Meeting, we will determine whether it is advisable to hold our Annual Meeting as a virtual meeting. Whatever format it ultimately takes, I hope you will be able to attend our Annual Meeting on May 6, 2020.great Company.

With appreciation,

|  | |

Donald Parfet Chairman of the Board | Peter Quigley President and CEO |

| 3 |

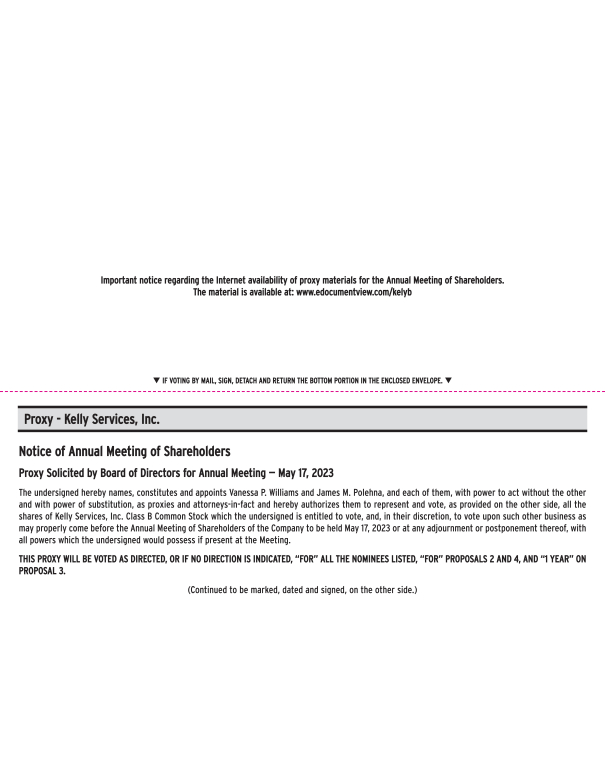

Notice of Annual Meeting of Shareholders

2023 Annual Meeting of Shareholders

| Date and Time: |  | |||

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

April 6, 2020

Dear fellow Stockholders:

We are pleased to invite you to join our Board, senior leadership, and other associates of Kelly Services, Inc., a Delaware corporation (the “Company”), for the Annual Meeting of Stockholders, to be held at the offices of the Company, 999 West Big Beaver Road, Troy, Michigan 48084-4716, on Wednesday, May 6, 2020 at 11:00 a.m., Eastern Daylight Time.

As a precaution regarding the Coronavirus orCOVID-19, we may hold our annual meeting over the web in a virtual meeting format instead of holding the meeting in Michigan. If we take this step, we would publicly announce a determination to hold a Virtual Annual Meeting in a press release available at kellyservices.com as soon as practicable before the meeting. The press release would include instructions as well as a webcast link from which to access the 2020 Annual Meeting of Stockholders on the above date and time, via live audio webcast, but only if the meeting is not held in Michigan.

At the Annual Meeting, you will be asked to consider the following proposals:

Wednesday, May 17, 2023 at 11:00 a.m., Eastern Daylight Time |

kellyservices.com | Close of Time, March 27, 2023 | ||

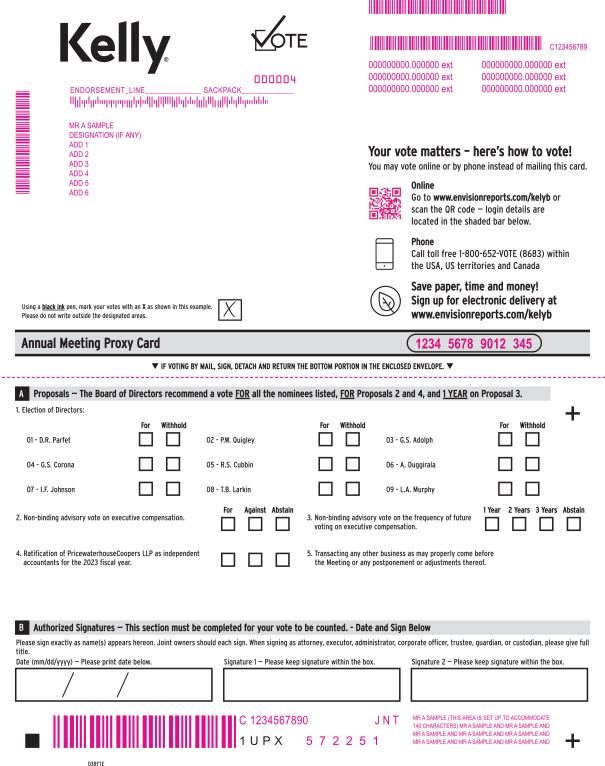

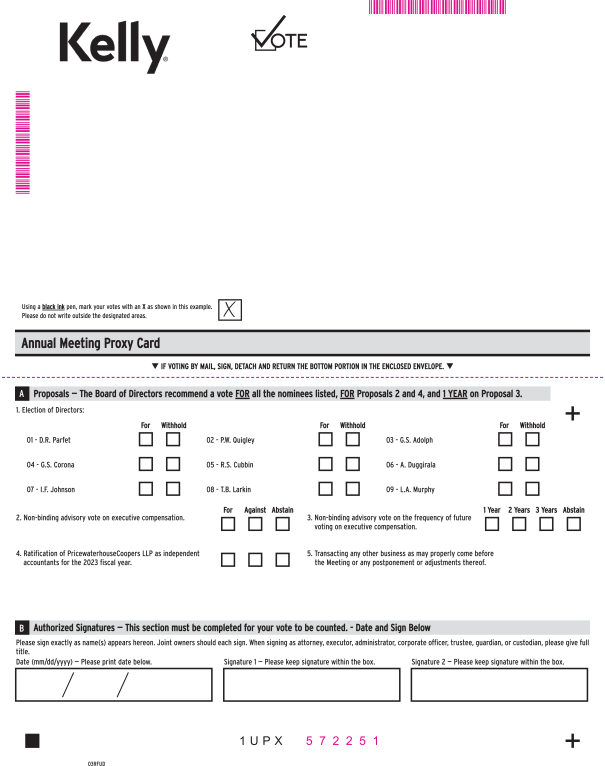

| Voting Matters | How to Vote | |||||

Proposal 1. Election of nine Board-recommended director nominees Proposal 2. Advisory approval of the Company’s executive | ||||||

Proposal 3. |

Proposal 4. Ratification of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the |

Proposal 5. Transaction of any other business as |

Online - www.envisionreports.com/kelyb |

QR code - Scan and vote with your mobile device | ||||||

Calling -1-800-652-VOTE (8683) Within the U.S., U.S. territories & Canada on a touch tone telephone |

Mail - Return the signed proxy card | |||||||

Proxies submitted online or by telephone must be received by 11:59 p.m., Central Daylight Time, on May 16, 2023. If you vote by mail, your proxy card must be received before the Annual Meeting. Beneficial owners, who own shares through a bank, brokerage firm, or other financial institution, can vote by returning the voting instruction form, or by following the instructions for voting via telephone or the Internet, provided by the bank, broker, or other organization. If you own shares in different accounts or in more than one name, you may receive different voting instructions for each type of ownership. Please vote all your shares. If you are a registered shareholder (i.e., you hold your shares through our transfer agent, Computershare), you may vote online, by telephone, or by mail. | ||||||||

may properly come before the | ||||||||

If you were a holder of record of the Company’s Class B Common Stock at the close of business on the Record Date, March 16, 2020,27, 2023, you are entitled to vote at the Annual Meeting.

Please promptly submit your vote by internet, telephone, or by signing, dating, and returning the enclosed proxy card or voting instructioninstructions form in the postage-paid envelope provided so that your shares will be represented and voted at the meeting.

Thank you for your interest in Kelly.

| By Order of the Board of Directors |

|

The following materials, also included with the Notice of Annual Meeting of Stockholders, are available for view on the Internet:

Proxy Statement for the Annual Meeting of Stockholders

JAMES M. POLEHNA

Corporate Secretary

Annual Report to Stockholders, includingForm 10-K, for the year ended December 29, 2019

To view the Proxy Statement or Annual Report visit: www.envisionreports.com/kelyb.

Please refer to the enclosed Proxy Card and Proxy Statement for information on voting options:

Internet — Scan QR Code — Telephone — Mail

| 4 |   |

|

| 51 | ||||

| Executive Summary | 52 | |||

| 53 | |||

| 54 | |||

| ||||

| 56 | ||||

| 56 |

| 5 |  |

Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement. Please refer to the complete Proxy Statement and Kelly’s 20192022 Annual Report before you vote.

2023 Annual Meeting of Shareholders Details

Class B Shareholders as of the Record Date are entitled to vote. Each share of Class B Common Stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on.

Admission

All holders of the Company’s Class A and Class B Common Stock are invited to attend the Annual Meeting of Shareholders.

Proxy Voting Roadmap

| ||||||||

| ||||||||

PROPOSAL 1. | Election of nine directors |

| ||||||

| Advisory vote to approve the Company’s executive compensation | |||||||

PROPOSAL 3. Advisory vote to approve annual |

PROPOSAL 4. Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the | |||||||

|  |  |  | |||||

|

|

| ✓ FOR | ✓ FOR | ||||

| page 15 | page 50 | page 85 | page 86 | ||||

Proxies submitted by the Internet or telephone must be received by 11:59 p.m., Central Daylight Time, on May 5, 2020. If you vote by mail, your proxy card must be received before the Annual Meeting.

Beneficial owners, who own shares through a bank, brokerage firm, or other financial institution, can vote by returning the voting instruction form, or by following the instructions for voting via telephone or the Internet, provided by the bank, broker, or other organization. If you own shares in different accounts or in more than one name, you may receive different voting instructions for each type of ownership. Please vote all your shares.

If you are astockholder of record or a beneficial owner who has alegal proxy to vote the shares, you may choose to vote in person at the Annual Meeting. If you plan to vote your shares at the meeting, please promptly request a legal proxy from your broker, as you will need to bring this with you to the meeting in order to vote your shares.Even if you plan to attend our Annual Meeting in person, please cast your vote as soon as possible.

| 6 |   |

Proxy Summary

DIRECTOR NOMINEESDirector Nominees

The following table provides summary information about each director nominee. Each director is elected annually by a plurality vote.

Name | Age | Director Since | Principal Occupation | Independent | Other Public Company Boards | |||||||||||

Donald R. Parfet | 67 | 2004 | Managing Director, Apjohn Group, LLC | Yes | 2 | |||||||||||

Peter W. Quigley | 58 | 2019 | President and Chief Executive Officer, Kelly Services, Inc. | No | — | |||||||||||

Carol M. Adderley | 60 | 2010 | Writer and Researcher in the Humanities | No | — | |||||||||||

Gerald S. Adolph | 66 | 2018 | Retired Senior Partner, Booz & Co.;Co-Chair, NAACP Legal Defense and Education Fund | Yes | 1 | |||||||||||

George S. Corona | 61 | 2017 | Retired President and Chief Executive Officer, Kelly Services, Inc. | No | — | |||||||||||

Robert S. Cubbin | 62 | 2014 | Retired President and Chief Executive Officer, Meadowbrook Insurance Group, Inc. | Yes | 1 | |||||||||||

Jane E. Dutton | 67 | 2004 | Robert L. Kahn Distinguished University Professor Emeritus of Business Administration and Psychology, The University of Michigan Business School | Yes | — | |||||||||||

Terrence B. Larkin | 65 | 2010 | Retired Executive Vice President, Business Development, General Counsel and Corporate Secretary, Lear Corporation | Yes | — | |||||||||||

Leslie A. Murphy | 68 | 2008 | President and CEO, Murphy Consulting, Inc.; Former Chair, American Institute of Certified Public Accountants | Yes | 1 | |||||||||||

Name | Age | Director Since | Position | Independent | Committees | |||||||||||

| Donald R. Parfet | 70 | 2004 | Non-Executive Chairman of the Board | ✓ | |||||||||||

| Peter W. Quigley | 61 | 2019 | President and Chief Executive Officer (“CEO”) | ||||||||||||

| Gerald S. Adolph | 69 | 2018 | Director | ✓ | • Audit • Compensation and Talent Management • Corporate Governance and Nominating | ||||||||||

| George S. Corona | 64 | 2017 | Director | ||||||||||||

| Robert S. Cubbin | 65 | 2014 | Director | ✓ | • Audit • Compensation and Talent Management (Chair) • Corporate Governance and Nominating | ||||||||||

| Amala Duggirala | 48 | 2022 | Director | ✓ | • Audit • Corporate Governance and Nominating | ||||||||||

| InaMarie F. Johnson | 58 | 2022 | Director | ✓ | • Compensation and Talent Management • Corporate Governance and Nominating | ||||||||||

| Terrence B. Larkin | 68 | 2010 | Director | ✓ | • Audit • Corporate Governance and Nominating (Chair) | ||||||||||

| Leslie A. Murphy | 71 | 2008 | Director | ✓ | • Audit (Chair) • Compensation and Talent Management | ||||||||||

| 7 |  |

Proxy Summary

CORPORATE GOVERNANCE HIGHLIGHTSCorporate Governance Highlights

Kelly is committed to sound corporate governance as a means of enhancing long-term stockholdershareholder value. HighlightsThe following table summarizes certain of our governance practices are described below.and processes.

Independence | Accountability | Best Practices | ||

• Majority independent Board |

|

| ||

| • Annual election of | • | ||

• | • Strong oversight of strategic planning, objectives, and | • Board attendance of | ||

• Diverse and highly skilled Board that provides a range of viewpoints | • Annual evaluation of | • Strong oversight of the integrity of the Company’s financial statements, as well as cybersecurity and Enterprise Risk Management (“ERM”) by the Board and Audit Committee | ||

• | • Annual Board and Committee self-evaluations and bi-annual peer review | • CEO and executive leadership succession planning and annual talent review of key and rising talent by the Board and Compensation and Talent Management Committee | ||

• | • Annual review of corporate governance documents |

| ||

|

| • Policies prohibiting short-sales, hedging, pledging, and margin accounts | ||

• No related party transactions between the Company and members of the Board or senior management | • Clawback policy that applies to short-term and long-term incentive compensation plans for senior management | • Strong oversight of Environmental, Social and Governance (“ESG”) standards by the Board and Corporate Governance and Nominating Committee | ||

• Stock ownership | • Comprehensive orientation program for new directors and robust continuing education programs | |||

73 YEARS OF INDUSTRY LEADERSHIP

|

Proxy Summary

Corporate Sustainability Strategy

We consider sustainability to be a guiding principle in strengthening the relationship with our global workforce, suppliers, and customers. As a leading provider of global workforce solutions, we connect people with employment opportunities and make a difference in the communities in which we live and work. Through our programs and initiatives, we seek to contribute to improving the quality of life of our employees, their families, as well as the communities in which we operate. Given the worldwide span of our workers, clients, suppliers, and partners, we recognize the global reach of both our business practices and our public accountability.

Since 2017,we embarked on a transformation from Corporate Social Responsibility initiatives, toward a long-term Corporate Sustainability Strategy aligned to our business core which contributes to the Sustainable Development Goals.

This new sustainability approach, rather than being philanthropic, is strategic to our business values. It is based on the concept of social investment, which, instead of aiding on isolated occasions, ensures the creation of future development capacities. We aim to guide all our subsidiaries and collaborators in the planning, management, and implementation of sustainable strategic approaches that create measured and impactful shared value to all our stakeholders.

Our Corporate Sustainability Strategy is defined as an integrated decision-making strategy that provides comprehensive guidelines for implementing internal actions toward these ends. These guidelines provide procedures and tools to ensure the applicability of the strategy on a worldwide basis–guaranteeing the same standards, metrics, and objectives for all our operations.

This strategy has been developed with consideration given to the perceptions of our stakeholders, as well as its impact on business operations.In early 2018,we conducted a material assessment that helped us define the policies and guidelines of our Corporate Sustainability Strategy.

Permanent monitoring of our sustainable performance is conducted on an annual basis by means of an interdisciplinary perspective assessment involving cross-functional areas within the company. Progress in our Corporate Sustainability Strategy are reported on an annual basis through the Global Reporting Initiative Standard (GRI), and Communications of Progress (following the UN Global Compact), which we support sinceFebruary 2019.

Sustainability is an integral part of our company’s strategy and operations. To learn more about our ESG program, please view our website athttps://www.kellyservices.com/global/about-us/corporate-sustainability/corporate-sustainability-program/.

|

Proxy Summary

Assessments, Recognition & Awards

| • | |||

|

| |||

|

| |||

|

| |||

|

| |||

| 8 |   |

Proxy Summary

FULL YEAR 2019 FINANCIAL SUMMARYMeet Today’s Kelly

(As Reported)

| Actual Results | Change | Constant Currency Change(1) | ||||||||||

Revenue | $ | 5.4B | (2.9 | %) | (1.9 | %) | ||||||

Gross Profit (“GP”)% | 18.1 | % | 50 bps | |||||||||

Earnings from Operations | $ | 81.8M | (6.5 | %) | (5.0 | %) | ||||||

Return on Sales (“ROS”)% | 1.5 | % | (10 | ) bps | ||||||||

Earnings per Share (“EPS”) | $ | 2.84 | $ | 2.26 | ||||||||

Revenue declined in Americas Staffing and International Staffing in the faceWe’re building on 75 years of a weakening manufacturing sector in the U.S. and softening demand in Europe, respectively. Global Talent Solutions (“GTS”) revenue improved year-over-yearindustry leadership.

GP rate improved from the impact of higher margin acquisitions and structural improvement in product mix in GTS

Earnings from Operations declined compared to last year as a higher GP rate on lower revenue resulted in lower gross profit. The decline was partially offset by lower performance-based incentive expenses and expense control efforts. Asset impairment and restructuring charges were partially offset by gain on sale of assets

EPS favorably impacted by a $0.63 gain on equity investment in 2019 compared to a $1.69 loss in 2018

› |

Top 3 | › | Leading | › | Star Performer | › | Partnering | |||||||||||||

on Staffing Industry Analysts 2022 lists of largest U.S. workforce providers: #1 in education, #2 in life sciences, and #3 in engineering | managed services provider (MSP) with $9.4 billion spend under management | in MSP, Services Procurement, and RPO on Everest Group’s 2022 PEAK Matrix assessment | with more than 4,600 talent suppliers globally | |||||||||||||||||

› | Powering | › | Leader | › | #1 of 100 | › | 8th year | |||||||||||||

the Fortune 500 with workforce solutions | in Engineering Contingent Staffing Services on Everest Group’s 2022 PEAK Matrix assessment | on Flex Job’s list of top companies for hybrid work in 2022 | of consecutively being named a Military-Friendly Employer | |||||||||||||||||

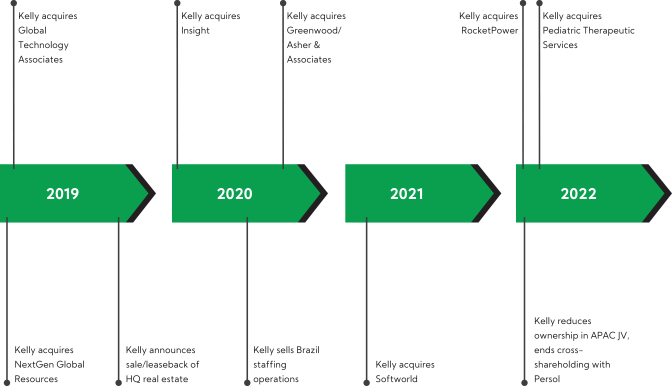

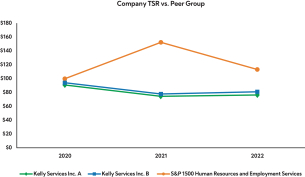

FULL YEAR 2019 FINANCIAL SUMMARYA Year in Review

(Excluding Gain/LossKelly entered 2022 squarely focused on investmentexecuting our specialty strategy and taking bold action to accelerate our strategic transformation, streamline our portfolio, and create value. Notwithstanding a dynamic geopolitical, macroeconomic, and labor environment that evolved throughout the year, we made steady progress on our growth journey. Kelly delivered revenue of $4.9 billion – an increase of 1.1% compared to 2021. The Company’s gross profit increased 10.1% from the prior year to more than $1 billion. We advanced our inorganic growth strategy by acquiring two companies: RocketPower, a leading provider of Recruitment Process Outsourcing (RPO) solutions; and Pediatric Therapeutic Services, a specialty firm that provides state and federally mandated in-school therapy services including occupational therapy, physical therapy, speech-language pathology, and mental and behavioral health services. We continued to make structural improvements in Persol Holdings, Acquisitions, Asset Impairment Charge, Restructuring, and Gain on Sale of Assets)our businesses as well by expanding our gross profit margin to 20.4% – marking the first time our gross profit margin has exceeded 20% in more than 25 years.

| Actual Results | Change | Constant Currency Change(4) | ||||||||||

Revenue(1) | $ | 5.2B | (5.4 | %) | (4.4 | %) | ||||||

Gross Profit %(1) | 17.8 | % | 20 bps | |||||||||

Earnings from Operations(1),(2) | $ | 78.9M | (9.7 | %) | (8.1 | %) | ||||||

Return on Sales %(1),(2),(3) | 1.5 | % | (10 | ) bps | ||||||||

Earnings per Share(1),(2),(3) | $ | 2.16 | ($ | 0.11 | ) | |||||||

Revenue declined in Americas Staffing and International StaffingStrong customer demand for our staffing services in the facefirst half of a weakening manufacturing sector2022 decelerated in the U.S.third quarter amid heightened macroeconomic uncertainty – a trend that persisted through the remainder of the year. Our higher-margin outcome-based solutions demonstrated greater resilience amid these headwinds, growing at a rapid pace. This dynamic was evident in our Professional & Industrial segment in which revenue decreased over the prior year, but gross profit margin grew to 18.2% – an increase of 130 basis points compared to 2022 driven by growing demand for outcome-based solutions. Revenue in our Education segment increased 52.7% as we captured additional growth opportunities and softening demandeffectively managed talent supply challenges. Our Science, Engineering & Technology segment grew revenue 9.4% which, combined with our ability to translate higher gross profit margins in Europe, respectively

GP rate improved duethis segment to structural improvementearnings growth, drove an 11.4% increase in product mixearnings from operations compared to 2022. We also achieved solid constant currency revenue growth in GTS, partially offsetInternational excluding our Russia operations, which we transferred to a Russian company in July. Revenue increased 8.3% in OCG, which also expanded its gross profit margin by lower perm fees

Earnings from Operations declined as360 basis points – the effectmost significant year-over-year increase of declining revenues was only partially offset by improving GP rate and reduced expenses from lower performance-based incentive expenses and effortsour five segments. Each of our five specialty business units will continue to align costs with revenue trends

EPS declinedmake strategic contributions to Kelly’s progress on lower earnings

|

|

2019 asset impairment charge of $15.8 million, $11.8 million net of tax or $0.30 per share;

2019 restructuring charges of $5.5 million, $4.1 million net of tax or $0.10 per share

|

2019 gain on investmentour growth journey in Persol Holdings of $35.8 million, $24.8 million net of tax or $0.63 per share;2023.

2018 loss on investment in Persol Holdings of $96.2 million, $66.8 million net of tax or $1.69 per share

|

| 9 |  |

Proxy Summary

EXECUTIVE COMPENSATION HIGHLIGHTS2022 Financial Highlights

Full Year 2022 Financial Summary

| Change Increase/(Decrease) | ||||||||||

|

| Actual Results | As Reported |

| As Adjusted(2) |

| |||||

Revenue | $5.0B | 1.1% | 1.1% | |||||||

| 3.2% CC(1) | 3.2% CC(1) | |||||||||

Gross Profit Rate | 20.4% | 170 bps | 170 bps | |||||||

Earnings from Operations | $14.8M | (69.7%) | 29.9% | |||||||

| (61.3%) CC(1) | 37.7% CC(1) | |||||||||

Adjusted EBITDA | $105.6M | 25.5% | ||||||||

Adjusted EBITDA Margin | 2.1% | 40 bps | ||||||||

| (1) | Constant Currency (“CC”) represents year-over-year changes resulting from translating 2022 financial data into USD using 2021 exchange rates |

| (2) | See reconciliation of Non-GAAP Measures included in Form 8-K dated February 16, 2023 |

Portfolio Progress

Our M&A activities are shifting our portfolio.

| 10 |  |

Proxy Summary

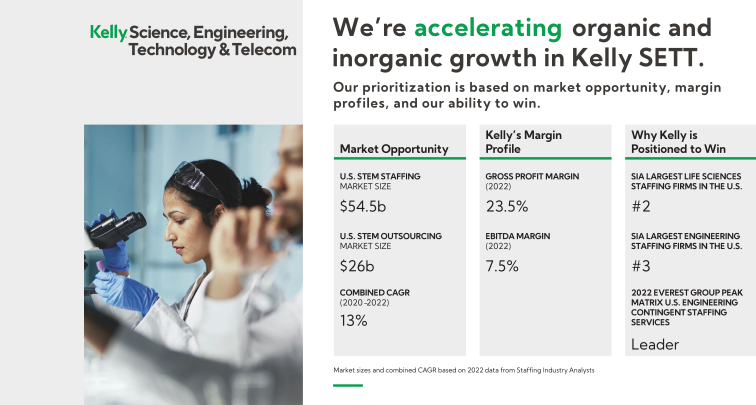

Our Operating Model Aligns to these Specialties

(As Reported, by Business Unit)

Our priorities for each segment are clear.

Optimize Operations and Drive Efficiencies | ® | Accelerate Organic and Inorganic Growth |

|

| Kelly Professional & Industrial | Kelly International | Kelly Science, Engineering, Technology & Telecom | Kelly Education | Kelly OCG | |||||

Revenue(1) | $1.7B | $0.9B | $1.3B | $0.6B(2) | $0.5B(3) | |||||

GP Rate(1) | 18.2% | 15.3% | 23.5% | 15.8%(2) | 36.3%(3) | |||||

Geography | North America | EM EA & Mexico | North America | U.S. | Global | |||||

Specialties | • Industrial • Contact Center • Office Clerical | • Life Sciences • IT • Finance • Other Local Professional Niches | • Engineering • Science & Clinical • Technology • Telecom | • Early Childhood • K-12 • Special Ed/Needs • Tutoring • Therapy Services • Higher Education • Executive Search | • MSP(4) • RPO(4) • PPO(4) • Consulting | |||||

| (1) | Kelly size and margin profiles are based on 2022 full year results |

| (2) | Kelly Education revenue and GP rate was $0.7B and 16.6%, respectively, including the results of PTS on a proforma basis |

| (3) | Kelly OCG revenue and GP rate was $0.5B and 36.7%, respectively, including the results of RocketPower on a proforma basis |

| (4) | Managed Service Provider (“MSP”); Recruitment Process Outsourcing (“RPO”); Payroll Process Outsourcing (“PPO”) |

| 11 |

Proxy Summary

| 12 |  |

Proxy Summary

Select Awards and Recognitions

We’re the best company for business and talent to work with. We’ve been recognized around the world and across the spectrum for what we do.

|

| |

Kelly has been named a Leader on Everest Group’s U.S. Business & Professional and Engineering Contingent Staffing Services PEAK Matrix® Assessment, as well as a Major Contender on Everest Group’s U.S. IT Contingent Staffing Services PEAK Matrix® | Kelly Named to Forbes List of America’s Best Employers for Diversity for second consecutive year, one of the top Professional Recruiting and Temporary Staffing Firms in America | |

|

|

| ||

KellyOCG named to HRO Today Enterprise RPO Baker’s Dozen List 2022 | For the 5th consecutive year, Kelly received a top score on the Human Rights Foundation’s Corporate Equality Index for Best Places to Work for LGBTQ Equality | Kelly was named to FlexJobs® Top 100 Companies for Remote Jobs in each of the nine years the award has been in existence, 2014-2022 | ||

|

|

| ||

Kelly was awarded the 2022 Military Friendly Employer and Military Friendly Spouse Employer designations by VIQTORY | In February 2022, Kelly Services Italy was awarded the Top Employer 2022 certification for fourth consecutive year. | KellyOCG Named a Great Place to Work in Australia, Malaysia, and India | ||

|  |

| ||

Kelly was recognized for its outsourcing excellence on the International Association of Outsourcing Professionals (IAOP) 2022 Global Outsourcing 100 List | Kelly named a 2022 Best in Class Award Winner for Supplier Diversity by the Great Lake Women’s Business Council | In February 2022, Computrabajo named Kelly as the Best HR Company to Work for in Mexico in their Best WorkPlaces 2022 ranking | ||

A complete list of the Company’s awards and recognitions is available on kellyservices.com.

| 13 |

Proxy Summary

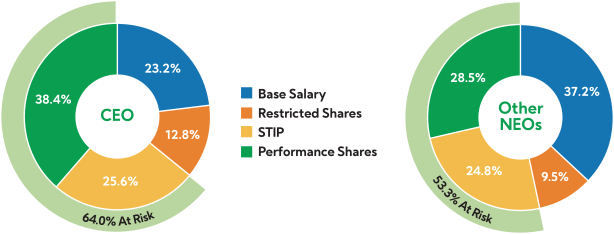

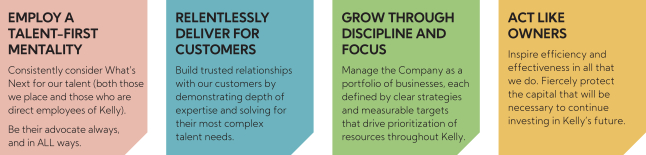

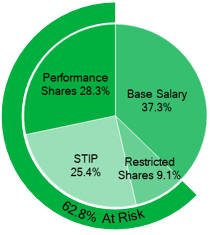

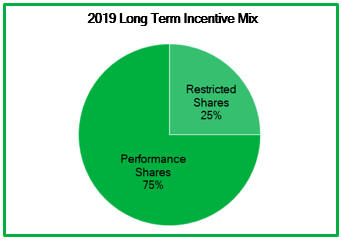

Executive Compensation Highlights

| ● | Align pay with performance |

•

| ● | Align executive compensation with |

•

| ● | Annual review of performance measures and goals for our |

•

| ● | Require the achievement of a minimum acceptable level of financial performance |

•

| ● | Include caps on individual |

•

| ● | Require stock ownership and retention of a portion of equity-based awards by senior officers |

•

| ● | Hold an annual |

•

| ● | Retain an independent executive compensation consultant to the Compensation and Talent Management Committee

|

| ● | Regular review of executive compensation governance market practices, particularly when considering the adoption of new practices or changes in existing programs or policies |

•

| ● | Conduct annual assessments of any potential risks in our incentive compensation programs and policies and related internal controls |

•

| ● | Annually review with the Compensation and Talent Management Committee share utilization, burn rate and dilution levels resulting from our compensation practices |

•

| ● | Provide for the forfeiture of equity awards upon certain restrictive covenant breaches and other actions constituting cause for termination |

| ● | Maintain an insider trading policy that requires directors, senior officers, and other designated officers of the Company to contact our Corporate Secretary prior to sales or purchases of common stock |

•

| ● | Maintain a |

•

| ● | Condition severance benefits for senior officers on compliance with restrictive covenants |

| ● |

|

•

| ● | Guarantee bonus arrangements with our senior officers |

•

| ● | Allow directors or senior officers to engage in hedging or pledging of Company securities |

•

| ● | Allow the repricing or backdating of equity awards |

• Beginning with 2017 grants to executive officers, pay

| ● | Pay dividend equivalents on

|

| ● | Pay dividends on performance share awards |

•

| ● | Provide tax reimbursements for perquisites or tax gross-ups for excise |

•

| ● | Grant incentive awards to senior officers that are not subject to the Company’s Incentive Compensation Recovery (“Clawback”) Policy |

•

| ● | Accrue additional retirement benefits under any supplemental executive retirement plans (“SERPs”) |

•

| ● | Provide excessive perquisites |

| 14 |   |

Proposal 1:1 – Election of Directors

PROPOSAL 1 – ELECTION OF DIRECTORS

The Board of Directors has nominated nine individuals for election as directors at the Annual Meeting, each to serve for one year and until his or her successor is elected and qualified. AllEach of these individuals areour director nominees currently servingserves on the Board. The other current director, Mr. Takao Wada, isBoard and was elected to a one-year term at the designated representative of our joint venture partner Persol Holdings Co., Ltd. (“Persol”). Mr. Wada is not standing forre-election and, following the2022 Annual Meeting Persol will not have a representative on the Board.of Shareholders.

Directors will be elected by a plurality of the votes cast by holders of Class B Common Stock who are present in person, or represented by proxy, and entitled to vote at the Annual Meeting. Our controlling stockholdershareholder, the Terrence E. Adderley Revocable Trust K (“Trust K”), has indicated its support and intention to vote for each of the director nominees.

We do not contemplate that any of the nominees will be unavailable to serve at the time of the Annual Meeting; inMeeting. In that event, however, the persons named in the enclosed form of proxy may vote for the election of a substitute selected by the Board or the Board may reduce its size.

On February 12, 2020, our Board affirmatively determined that directors Gerald S. Adolph, Robert S. Cubbin, Jane E. Dutton, Terrence B. Larkin, Leslie A. Murphy, and Donald R. Parfet, representing a majority of the Board, are independent. The Board’s Corporate Governance Principles include guidelines for director independence that conform to the listing standards of the Nasdaq Global Market (“Nasdaq”) on which the Company’s common stock is listed.

listed and provide that a majority of the Board Nominees

Thebe comprised of independent directors. Annually, Kelly’s Corporate Governance and Nominating Committee is responsible for identifyingevaluates and recommendingmakes recommendations to the Board qualified candidates for Board membershipconcerning the independence of each director and director nominee, evaluating any relationship with the goalCompany or its competitors, suppliers, customers, service providers, or others that might be construed as an actual or potential conflict of buildinginterest.

On February 15, 2023, our Board affirmatively determined that directors Gerald S. Adolph, Robert S. Cubbin, Amala Duggirala, InaMarie F. Johnson, Terrence B. Larkin, Leslie A. Murphy, and Donald R. Parfet, representing a Board that is effective, collegial, diverse, and responsive to the current and anticipated needsmajority of the Company. The Committee considers the following criteria: (i) ethics, character, and judgment; (ii) business and other experience, expertise, skills, and knowledge relevant to the Company’s business and strategy; (iii) objectivity and independence of thought; (iv) diversity of background, experience, and personal characteristics such as gender, race, ethnicity, sexual orientation, and age; and (v) the interplay of the candidate’s qualities with those of other members of the Board. In determining whether to recommend a director forre-nomination, the Committee also considers the director’s recent contributions and potential for continuing contributions to the work of the Board. The Board, has not adopted a policy whereby stockholders may recommend nominees to the are independent.

Board because of the Company’s status as a controlled company.Nominees

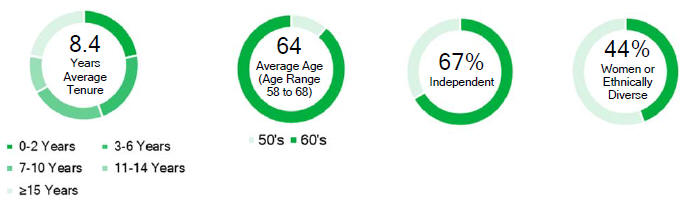

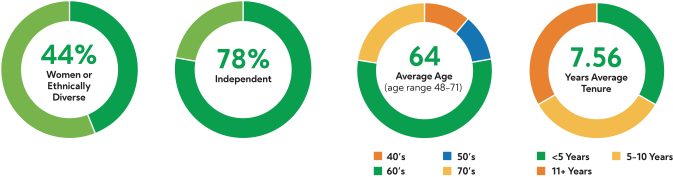

Each of our director nominees has been recommended for election by our Corporate Governance and Nominating Committee and nominated by our Board. They are seasoned leaders who have held an array of diverse leadership positions in public and private companies, nonprofit organizations, and other businesses. They represent diverse backgrounds and viewpoints.

Together, they bring to our Board broad diversity in terms of experience, skills, and personal attributes. The Board believes that this diversity strengthens the Board’s ability to carry out its oversight role on behalf of stockholders.shareholders and is proud of the Company’s long history of having at least three directors who are women on the Board for the past 14 years. While we do not have a formal diversity policy, the Board will seekcontinue to build upon its diversity in connection with future refreshment.Board membership.

For each of the nine director nominees standing for election, the following pages set forth certain biographical information, including a description of their principal occupation, business experience, and the primary qualifications, experience, skills, and attributes that the Corporate Governance and Nominating Committee considered in recommending them as director nominees, as well as the Board committees on which each director nominee will serve as of the 2023 Annual Meeting. The charts on diversity, independence, age, tenure, skills, experience, and attributes assume that all director nominees are elected as directors at the Annual Meeting. Age and tenure for each director nominee is effective as of April 17, 2023.

Board Composition

The following graphics highlightCorporate Governance and Nominating Committee is responsible for identifying and recommending to the personal diversityBoard qualified candidates for Board membership as well as assessing the experience and breadthskills of the Company’s current directors. The Committee regularly reviews the mix of individual qualifications, experience, skills, knowledge,and attributes of incumbent directors to assess overall Board composition and define Board succession goals. This includes identifying areas of opportunity, specifically with respect to the need to refresh the Board with new members with particular expertise and experience that are represented onwould enhance the Board. A particular director may possess other skills, knowledge, or experience in additionoverall strength of the current Board and the ability of the Company to those noted below.execute its long-term strategic plan. Ongoing strategic Board succession planning ensures that the Board continues to maintain an

| 15 |  |

Proposal 1: Election of Directors

BOARD DIVERSITYappropriate mix of objectivity, skills, and experiences to provide fresh perspectives and effective oversight and guidance to management while leveraging the institutional knowledge and historic perspective of our longer-tenured directors. The Committee’s goal is to build an effective and well-functioning Board with diverse perspectives and viewpoints that is responsive to the current and anticipated needs of the Company and long-term interests of shareholders.

The Committee considers the following core qualifications for Board composition that are critical to the success of our business:

the highest personal and professional ethics, integrity, and values;

objectivity and independence of thought and leadership;

strength of character and sound judgment;

strong interpersonal and communication skills; and

highly accomplished in his or her respective field.

Director candidates must also have a willingness to devote sufficient time to discharge their duties, taking into consideration principal occupation, memberships on other boards, attendance at Board and committee meetings, and other responsibilities. In addition, director candidates must have an intention to serve an appropriate length of time in order to make a meaningful contribution to the Company and the Board. Each of our director nominees demonstrates the core qualifications listed here.

EXPERIENCE AND QUALIFICATIONSThe Committee also considers specific criteria as provided below, that varies from time to time based on the Company’s current and future priorities and needs, and the balance of the candidate’s experiences, skills, and attributes with those of other members of the Board.

The Committee considers the following specific experience and skills for Board composition, as illustrated in our Board Composition Matrix on the next page:

| • | Executive Leadership, including experience as a Chairman of the Board, Chief Executive Officer, Chief Operating Officer, or substantially equivalent level executive officer of a complex organization such as a corporation, university, or major unit of government or a professional who regularly advises such organizations. Directors with this level of experience typically possess strong leadership qualities and the ability to identify and develop those qualities in others. They understand strategy, productivity, and risk management, and how these factors impact the Company’s operations and controls. These directors demonstrate a practical understanding of how large, complex organizations operate, the importance of talent management, and the method of setting employee and executive compensation. |

| • | Transformation, successful leadership of large-scale transformations, including cultural evolutions, restructuring, and enhancing organizational design to improve effectiveness, leveraging change management principles and tools to architect the culture needed to drive profitable growth. Directors with this experience and skillset help the Company focus its efforts in this important area and track progress against strategic goals and benchmarks. |

| • | Innovation, experience as innovative leader with proven experience turning new ideas and technologies into assets that transform businesses; embraces the idea of doing things differently; empowers employees to be creative and challenge the status quo; and views collaboration across all levels of the organization as an opportunity to tap diverse viewpoints. Directors who have this skillset help ensure the Company stays competitive by creating a culture of continuous improvement. |

| • | Industry, including experience in the staffing or business services industry, the Company’s specialty businesses, or experience in human capital management including talent/workforce solutions; diversity, equity, and inclusion; organizational behavior; and compensation and benefits. Directors with this experience bring value to the Board through oversight ensuring the Company maintains a successful framework for workforce acquisition, management, and optimization that results in the attraction, development, and retention of top candidates with diverse skills and backgrounds. |

| 16 |  |

Proposal 1: Election of Directors

| • | Technology, Digitization, and Cybersecurity, experience in the high-level planning and execution of business initiatives through use of technology and digitization to build business efficiencies and competitive advantage; proactive leader in enabling the business to achieve objectives through the effective use of technology and technological innovation and modernization; experience defining opportunities and prioritizing technology projects based on predefined criteria (e.g., ROI, productivity, compliance). Experience in the development of technology and processes that protect the storage of information and maintain confidentiality or expertise including a meaningful understanding of the challenges posed by cybersecurity risks. Directors with expertise in these areas are skilled at overseeing the organization’s management of technological change and cybersecurity risk. |

| • | Financial Acumen, including the ability to read and understand fundamental financial statements, including a company’s balance sheet, income statement, and cash flow statement. Directors with financial experience are essential for ensuring effective oversight of the Company’s financial measures, processes, reporting, and performance. |

| • | Financial Expert, including financial and/or accounting expertise, generally, and as necessary to fulfill the financial requirements of NASDAQ and the Securities and Exchange Commission (education and experience as CFO, finance/accounting executive, public accountant or auditor, or person performing similar functions). |

| • | Risk Management, experience identifying, evaluating, and managing corporate risk, ability to address and mitigate material risks. Directors with experience in this area are critical to ensuring the Board’s successful oversight of Company risks. |

| • | Legal or Corporate Governance, experience with the legal issues impacting large organizations and the governance and fiduciary matters that impact boards, such as service on public boards and board committees, or as legal or governance executives of other large public companies. Directors with this experience help the Company support its goals of strong Board and management accountability, transparency, and protection of shareholder interests. |

| • | ESG and Sustainability, experience with the development and oversight of an effective corporate responsibility strategy, initiatives, and practices that include social, climate and environmental initiatives. Directors who possess these skills strengthen the Board’s oversight and assure that strategic business imperatives and long-term value creation are achieved within a sustainable, environmentally, and socially focused model. |

| • | Mergers & Acquisitions, experience implementing organic and inorganic strategies, increasing revenue, building strategic partnerships to promote growth, identifying acquisition and business combination targets, analyzing cultural and strategic fit, and oversight of successful integration. Director experience in this area is particularly important as the Company continues to drive profitable growth in its areas of specialization. |

In determining whether to recommend a director for re-nomination, the Committee also considers the director’s recent contributions and potential for continuing contributions to the work of the Board. The Committee may engage third parties to assist in the search for director candidates. The director selection process is described in greater detail in the “Corporate Governance” section of this Proxy Statement.

The matrix below is a summary of the range of key experience, skills, and attributes that each director nominee brings to our Board and illustrates Kelly’s well-balanced Board composition relative to experience, skills, tenure, and diversity. This is a product of the Board’s careful succession planning, commitment to diverse and independent representation, and implementation of a sound and strategic Board refreshment process. Because it is a summary, it is not intended to be a complete description of each director nominee’s strengths or contributions to the Board. Additional details on each director nominee’s qualifications, experiences, skills, and attributes are set forth in their biographies.

| 17 |

Proposal 1: Election of Directors

| Board Composition Matrix (2023) | |||||||||||||||||||||||||||||||||||||||||||||

| Director Nominees | |||||||||||||||||||||||||||||||||||||||||||||

| Specific Experience and Skills (May vary based on current and future Company priorities/needs) | COB Parfet | CEO Quigley | Dir Adolph | Dir Corona | Comp Chair Cubbin | Dir Duggirala | Dir Johnson | Gov Chair Larkin | Audit Chair Murphy | ||||||||||||||||||||||||||||||||||||

Executive Leadership | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||

Transformations | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||||

Innovation | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||

Industry | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||||

Technology, Digitization, and Cybersecurity | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||||||

Financial Acumen | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||

Financial Expert | ● | ● | |||||||||||||||||||||||||||||||||||||||||||

Risk Management | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||

Legal or Corporate Governance | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||

ESG & Sustainability | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||||||||

Mergers & Acquisitions | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||

Other Public Board Experience (other than Kelly) | |||||||||||||||||||||||||||||||||||||||||||||

Audit Committee | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||

Compensation Committee | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||||||||

Governance & Nominating Committee | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||||

Tenure and Independence | |||||||||||||||||||||||||||||||||||||||||||||

Board Tenure (years) | 18 | 3 | 5 | 5 | 8 | 1 | 1 | 12 | 15 | ||||||||||||||||||||||||||||||||||||

Independence | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||

Demographics | |||||||||||||||||||||||||||||||||||||||||||||

Age | 70 | 61 | 69 | 64 | 65 | 48 | 58 | 68 | 71 | ||||||||||||||||||||||||||||||||||||

Gender Identity | M | M | M | M | M | F | F | M | F | ||||||||||||||||||||||||||||||||||||

African American or Black | ● | ● | |||||||||||||||||||||||||||||||||||||||||||

Alaskan Native or American Indian | |||||||||||||||||||||||||||||||||||||||||||||

Asian | ● | ||||||||||||||||||||||||||||||||||||||||||||

Hispanic or Latinx | |||||||||||||||||||||||||||||||||||||||||||||

Native Hawaiian or Pacific Islander | |||||||||||||||||||||||||||||||||||||||||||||

White | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||||||

Two or More Races or Ethnicities | |||||||||||||||||||||||||||||||||||||||||||||

LGBTQ+ | |||||||||||||||||||||||||||||||||||||||||||||

Did Not Disclose Demographic Background | |||||||||||||||||||||||||||||||||||||||||||||

| 18 |  |  |

Proposal 1: Election of Directors

Biographical Information About Director NomineesBoard Diversity

Director Qualifications and Experience

Executive Leadership | ||||||||||||||||||

| 9 of 9 directors | ||||||||||||||||||

Transformations | ||||||||||||||||||

| 8 of 9 directors | ||||||||||||||||||

Innovation | ||||||||||||||||||

| 7 of 9 directors | ||||||||||||||||||

Industry | ||||||||||||||||||

| 8 of 9 directors | ||||||||||||||||||

Technology, Digitization, and Cybersecurity | ||||||||||||||||||

| 6 of 9 directors | ||||||||||||||||||

Financial Acumen | ||||||||||||||||||

| 9 of 9 directors | ||||||||||||||||||

|

|  |

| |||||||||||||||

| ||||||||||||||||||

| 2 of 9 directors | |||||||||||||||||

Risk Management | ||||||||||||||||||

| 7 of 9 directors | ||||||||||||||||||

Legal or Corporate Governance | ||||||||||||||||||

| 7 of 9 directors | ||||||||||||||||||

ESG & Sustainability | ||||||||||||||||||

| 4 of 9 directors | ||||||||||||||||||

Mergers & Acquisitions | ||||||||||||||||||

| 9 of 9 directors | ||||||||||||||||||

| 19 |

Proposal 1: Election of Directors

Biographical Information About Director Nominees

|

Board Committees ● None Principal Occupation and

|

| ||||

|

| |||||

| ||||||

| Specific Experience and ● Executive Leadership ● Transformations ● Innovation ● Industry ● Financial Acumen ● Legal/Corporate Governance ● Mergers & Acquisitions | ||||||

|

Board Committees ● None Principal Occupation and Directorships ● President and Chief Executive Officer, Kelly Services, Inc. (2019 - present) ● Executive Vice President, President of Global Staffing and General Manager of IT, Global Service, and Global Business Services, Kelly Services, Inc. (2017 - 2019) ● Senior Vice President, General Counsel, Chief Administrative Officer and Assistant Secretary, Kelly Services, Inc. (2015 - 2017) Education ● National Law Center at George Washington University, JD ● University of Michigan, BA Mr. Quigley was appointed President and Chief Executive Officer of Kelly in October 2019. | |||||

| Specific Experience and ● Executive Leadership ● Transformations ● Innovation ● Industry ● Technology/Digitization/ Cybersecurity ● Financial Acumen ● Risk Management ● Legal/Corporate Governance ● ESG/Sustainability ● Mergers & Acquisitions | ||||||

| 20 |   |

Proposal 1: Election of Directors

|

|  |

| |||

Board ● Audit

● Corporate Governance and Nominating |

| |||||

Principal Occupation and

|

● Board Chair, Cardinal Spellman High School Board (2022 - present)

| |||||

|

| |||||

|

| |||||

● Executive Leadership

● Transformations

● Innovation

● Industry

● Technology/Digitization/

Cybersecurity

● Financial Acumen

● Legal/Corporate

Governance

● ESG/Sustainability

● Mergers & Acquisitions

|

Proposal 1: Election of Directors

|

|  |

| |||

Board ● None

|

| |||||

Principal Occupation and

|

| |||||

|

| |||||

| ||||||

| Specific Experience and Skills ● Executive Leadership ● Innovation ● Industry ● Technology/Digitization/ Cybersecurity ● Financial Acumen ● Risk Management ● Mergers & Acquisitions | ||||||

| 21 |

Proposal 1: Election of Directors

|

Board Committees ● Audit ● Compensation and Talent Management (Chair) ● Corporate Governance and Nominating Principal Occupation and Directorships ● Director, Huntington Bancshares Incorporated (2017 - present) ● Director, First Merit Corporation (2013 - 2017) ● President and Chief Executive Officer, Meadowbrook Insurance Group, Inc. (2002 - 2016) Education ● Detroit College of Law, JD ● Wayne State University, BA, Psychology Mr. Cubbin is an attorney with 31 years of experience in insurance law. In 2016, he retired as President and Chief Executive Officer of an insurance company. | |

| Specific Experience and Skills ● Executive Leadership ● Transformations ● Innovation ● Industry ● Financial Expert ● Risk Management ● Legal/Corporate Governance ● Mergers & Acquisitions | ||

|

Board Committees ● Audit ● Corporate Governance and Nominating Principal Occupation and Directorships ● Executive Vice President and Chief Information Officer, United Services Automobile Association (USAA) (2022 – present) ● Senior Executive Vice President, Chief Operations and Technology Officer, Regions Financial Corporation (2017 – 2021) ● Director, Innovation Depot (2021) ● Director, Regions Bank (2019 – 2022) ● Director, Techbridge, Inc. (2016 - 2020) Education ● Columbia University, MS, Technology Management ● University of Nebraska at Omaha, MBA, International Business ● Osmania University, BS, Electronics and Communications Engineering Ms. Duggirala joined our Board in January 2022 with more than 24 years of leadership experience with global organizations. She is a renowned digital transformation and technology strategist with skills in large-scale strategic product delivery, technical innovation, and complex financial management. She brings to the Board a wealth of knowledge in integrations, strategic planning, product development, operations, engineering, data management, and cybersecurity. Ms. Duggirala has significant cybersecurity experience from working in a variety of information technology and data analytics roles, including Chief Operations and Technology Officer at Regions Bank and Chief Technology Officer at other large fintech firms. In 2022, Ms. Duggirala received the esteemed Outstanding 50 Asian Americans in Business Award. | |

| Specific Experience and Skills ● Executive Leadership ● Transformations ● Innovation ● Industry ● Technology/Digitization/ Cybersecurity ● Financial Acumen ● Risk Management ● Legal/Corporate Governance ● ESG/Sustainability ● Mergers & Acquisitions | ||

| 22 |   |

Proposal 1: Election of Directors

|

● Compensation and Talent Management ● Corporate Governance and Nominating Principal Occupation and Directorships ● Chief People and Diversity Officer, Zendesk, Inc. (2018 – 2022) ● Senior Vice President and Chief Human Resources Officer, Plantronics, Inc. (2015 – 2018) ●Director, ● Member of CNBC’s Workforce Executive Council (2021 – present) Education ● John F. Kennedy University, MA, Organizational Development and Management ● University of California, BA, Social Sciences (Emphasis in Human Resources Management) Ms. Johnson joined our Board in January 2022 with more than 30 years’ experience in strategy transformation, human capital management, and operational excellence in multiple industries. She is an accomplished human capital transformational leader championing initiatives that transform the mindsets and behaviors that shape a culture. Ms. Johnson has extensive human capital management experience acquired from her previous HR leadership roles with several large organizations. Her expertise in organizational development and management provides the Board with a fundamental view on employee experience, talent acquisition, development, and diversity, equity, and inclusion. Ms. Johnson was recognized by The California Diversity Council as one of California’s Most Powerful & Influential Women. | |||||

| Specific Experience and Skills

● Industry ● Technology/Digitization/ Cybersecurity ● Financial Acumen ● Risk Management ● ESG/Sustainability ● Mergers & Acquisitions | |||||

|

Board ● Audit

|

| ||||

Principal Occupation and

|

| |||||

|

| |||||

|

| |||||

| Specific Experience and Skills ● Executive Leadership �� Transformations ● Financial Acumen ● Risk Management ● Legal/Corporate Governance ● Mergers & Acquisitions | ||||||

| 23 |  |

Proposal 1: Election of Directors

|

| |||||

Board

● Compensation and Talent Management

|

| |||||

Principal Occupation and

| ||||||

● University of Michigan, BBA, Accounting | ||||||

Ms. Murphy is a certified public accountant, former chair of the American Institute of Certified Public Accountants, and former Group Managing Partner of Plante & Moran, LLP, a national accounting firm. The Board | ||||||

| Specific Experience and Skills ● Executive Leadership ● Transformations ● Industry ● Technology/Digitization/ Cybersecurity ● Financial Expert ● Risk Management ● Legal/Corporate Governance ● Mergers & Acquisitions | ||||||

| 24 |   |

Corporate Governance

Compliance with Nasdaq Independence Standards forNon-Controlled Companies

Nasdaq, on which the Company’s common stock is listed, has established exemptions from its governance requirements for “controlled companies,” defined as companies in which a single person, entity, or group holds more than 50% of the voting power for the election of its directors. The Company is a “controlled company” by virtue of the fact that the Terence E. Adderley Revocable Trust K, (“Trust K”), discussed below, has the power to vote approximately 91.6%93.9% of the Company’s outstanding shares of Class B Common Stock.

In keeping with the Company’s historic recognition of the importance of having a majority of independent directors, the Company has elected to comply voluntarily with all the Nasdaq listing standards that otherwise do not apply to controlled companies. Thus, a majority of the Board are independent directors all members of the Compensation Committee are independent directors and all members of the three Board Committees, Audit, Committee are independent directors (which is a Nasdaq requirement for all listed companies). Commencing with the Annual Meeting of the Board to be held on May 6, 2020, when committee assignments will be made, all members of theCompensation and Talent Management, and Corporate Governance and Nominating, Committee will be independent directors and the Company will fully satisfy the Nasdaq independence standards for boards and board committees ofnon-controlled companies.are independent.

Prior to his death in October 2018, Mr.Terence E. Adderley, our former Chairman, was the trustee of Trust K. Upon his death, Trust K became irrevocable and, in accordance with the provisions of the trust, Andrew H. Curoe, David M. Hempstead, and William U. Parfet were appointed as successor trustees (the“co-trustees”). Theco-trustees are required to act by a majority vote in voting andwhen making investment decisions with respect to the Class B Common Stockvoting shares held by Trust K. The co-trustees, acting as a majority, have sole voting and investment authority over Trust K and cannot be removed or replaced by the beneficiaries of Trust K.

William U. Parfet, aco-trustee, is the brother of Donald R. Parfet, Chairman of the Board. In determining that Donald R. Parfet is an independent director, the Board considered, among other things, that Donald R. Parfet and William U. Parfet are financially independent of one another, that theco-trustees are required to act by majority vote and that none of theco-trustees serves as an officer or director of the Company or has any personal financial interest in Trust K that could benefit from actions taken by the Board.

Role of the Board of Directors

The Board bears responsibility for the oversight of management on behalf of shareholders in order to ensure long-term value creation. In that regard, the Board oversees and provides guidance for the Company’s business, property, and affairs. On an ongoing basis, the Board oversees management’s development and implementation of the Company’s strategy and business planning process, and monitors performance relative to the achievement of those plans. The Board sets the tone at the top to support a corporate culture that emphasizes ethical standards, professionalism, integrity, and compliance. The Board and its committees consider long-range strategic issues and material risks facing the Company, together with management’s actions to address and mitigate these risks; oversee corporate policies and processes to promote and maintain the integrity of the Company’s financial reporting and controls, legal and ethical compliance, and relationships with customers and suppliers; review the Company’s sustainability practices and strategies; and provide oversight relative to the compensation of senior management, leadership development, and management succession planning.

As part of its oversight of the strategic direction of the Company, senior leadership presents to the Board at the beginning of each year the annual business plans for each business unit and the consolidated annual business plan for the Company as a whole. At each subsequent meeting throughout the year, management shares quarterly performance results for each business unit and the whole Company, and the Board discusses how these outcomes compare to the annual plans. Each year, the Board engages in a two-day offsite strategic planning meeting with management where it conducts a comprehensive review and discussion of the Company’s strategic direction and goals over the short-, medium-, and long-term, as well as management’s plans to achieve such goals. At least twice each year, the business unit presidents provide an in-depth review and update of their businesses to the Board, which includes a review of the strategic goals of the business and business performance relative to business strategy.

| 25 |

Corporate Governance

Board Leadership and Governance Structure

The Board is responsible for establishing and maintaining the most effective leadership structure for the Company. At the present time, the Board has determined that the roles of the Chairman of the Board and the Chief Executive Officer should be separate, with the Chairman being an independent director, because that structure affords independent Board leadership and allows the Chief Executive Officer to concentrate on the Company’s business. Donald R. Parfet serves as Chairman of the Board and Peter W. Quigley serves as Chief Executive Officer.

The Chairman of the Board’s duties include consulting with and advising our Chief Executive Officer, presiding over meetings of the Board and, together with our Chief Executive Officer, presiding over meetings of stockholders.shareholders. The Chairman of the Board’s duties also include providing effective leadership to the Board including ongoing monitoring of its performance, compliance with governance requirements and best practices, serving as liaison among the Chief Executive Officer and the independent directors, establishing the annual schedule for Board meetings (in consultation with the Chief Executive Officer), developing and approving agendas for Board meetings, working with the Chief Executive Officer to ensure that information flows to the Board to facilitate understanding of, and discussion regarding, matters of interest or concern to the Board, approving the information sent to the Board for meetings, establishing the schedule and agendas for and presiding over meetings of the independent directors in executive session, providing feedback to the Chief Executive Officer on those executive sessions, authority to call and preside over special meetings of the Board, and facilitating discussions among independent directors on key issues outside of Board meetings.

In the event that the Chairman of the Board is not an independent director, the Company’s Corporate Governance Principles provide that the independent directors will elect one of their number to serve as Lead Director and fulfill many of the Chairman of the Board’s current responsibilities.

The Chief Executive Officer is responsible for managing the business and affairs of the Company, subject to the oversight of the Board. The Chief Executive Officer’s duties include leadinginclude: providing leadership to the Company’s management team,team; developing and presenting to the Board the Company’s strategy and long-term plans, medium-term plans and annual budgets, and within this framework, the performance of the business; complying with legal and corporate governance requirements, making recommendations on the appointment and compensation of executive officers, management development, and succession planning; representing the Company externally,externally; consulting with the Chairman of the Board about developments in the Company,Company; and communicating with all directors about key issues outside of Board meetings.

|

Corporate Governance

| ||||||||

| ||||||||

| ||||||||

The Board has established three standing committees: an Audit Committee, a Compensation and Talent Management Committee, and a Corporate Governance and Nominating Committee. Each committee functions under a written charter adopted by the Board, which is available on the Company’s website atkellyservices.com or to any stockholdershareholder who requests a copy. The current members, responsibilities, and the number of meetings each of these committees held in 20192022 are shown below.

| Audit Committee All Independent |  | Compensation and Talent Management Committee All Independent |  | Corporate Governance and Nominating Committee All Independent |

| 26 |  |

Corporate Governance

| Audit Committee |  | |

Members: All Independent

Leslie A. Murphy (Chair)

Gerald S. Adolph Robert S. Cubbin Amala Duggirala Terrence B. Larkin Meetings in

The Board | Key Responsibilities: • Oversees and reports to the Board with respect to the quality, integrity, and • Appoints, compensates, and evaluates the qualifications, independence, and performance of the independent auditor • Oversees the performance of the internal audit function, including the Chief Audit Executive (“CAE”) • Oversees the Company’s Enterprise Risk Management Program • Reviews and discusses with management the Company’s major financial, security, and cybersecurity risk exposures and the steps management has taken to monitor and control such exposures • Monitors the Company’s compliance with legal and regulatory requirements • Oversees sustainability/ESG disclosures, controls, processes, and assurance • Reviews and approves related party transactions • Serves as the Company’s Qualified Legal Compliance Committee with respect to reports of potential material violations by the Company or its officers, directors, employees, or agents, of applicable U.S. federal or state law or fiduciary duty arising under such law, and of the Company’s policies including the Code of Business Conduct and Ethics • Reviews and approves Internal Audit’s budget and resource plan • Regularly holds separate sessions with Kelly’s management, internal audit, and PricewaterhouseCoopers | |

| 27 |

Corporate Governance

| Compensation and Talent Management Committee |  | |

Members: All Independent

Robert S. Cubbin (Chair) Gerald S. Adolph InaMarie F. Johnson Leslie A. Murphy

Meetings in

| Key Responsibilities: • Develops the Company’s compensation philosophy • Designs and administers the Company’s executive compensation programs and policies that are aligned with business and compensation objectives • Determines annually, for senior officers (including the CEO), corporate and business unit goals and establishes the level of performance that must be achieved for each • • Reviews stock ownership requirements for requirements • Reviews and makes recommendations to the Board concerning director compensation • Reviews and advises the Board concerning CEO and senior officer succession planning and developmental opportunities • Reviews and makes recommendations to the Company’s ESG Strategy and related risk management policies and procedures relative to human capital management • Appoints, compensates, and oversees the work performed by an independent compensation or legal advisor • Oversees the Company’s strategies, initiatives, and programs related to human capital management and determines their effectiveness, including with respect to diversity, equity, and inclusion, workplace and culture, benefits and well-being, employee engagement, performance management, and talent recruitment, development, and retention | |

Compensation and Talent Management Committee Interlocks and Insider Participation

During 2022, none of the Company’s executive officers served on the Board of Directors of any entities whose directors or officers served on the Company’s Compensation and Talent Management Committee. No current or past executive officers of the Company or its subsidiaries serve on the Compensation and Talent Management Committee.

| 28 |   |

Corporate Governance

| Corporate Governance and Nominating Committee | ||

| ||

Members:

Terrence B. Larkin (Chair)

Gerald S. Adolph Robert S. Cubbin Amala Duggirala

| Key Responsibilities:

• Develops and oversees compliance with the Company’s Corporate Governance Principles • Reviews and makes recommendations to the Board with respect to corporate governance matters generally • Engages in succession planning for our Board of Directors • Makes recommendations to the Board regarding the size, composition, and leadership structure of the Board and its committees • Identifies and assesses the independence, backgrounds, and skills required for members of the Board and Board committees • Identifies, considers, and recommends, consistent with criteria approved by the Board, qualified candidates for election as directors, including the slate of directors to be nominated by the Board for election at the Company’s Annual Meeting • Oversees the orientation and education of new directors • Oversees the annual evaluation process of the Board and Board committees, as well as the director peer review • Oversees and periodically reports to the Board on matters concerning the Company’s Corporate ESG Strategy including corporate responsibility and sustainability performance • Reviews and | |

The Board is committed to ensuring that the Company has the right executive leadership team in place. Under our Chief Executive Officer’s leadership, the Company has transformed the management team by elevating strong internal talent while bringing in people with the experience and skills necessary for our success.

The following lists our executive officers as of April 17, 2023. Additional biographical information for each of our executive officers can be found at kellyservices.com.